MONTHLY JOURNEY TO FINANCIAL FREEDOM: 50th

- BecomingFI

- Apr 25, 2022

- 5 min read

Fears of an escalation of the war between Russia and Ukraine had a negative impact on stock markets around the world in early March 2022. However, towards the end of the month, stocks appreciated, with the exception of the Chinese stock exchange, which fell. mainly due to the lockdown adopted in the country to prevent the spread of coronavirus cases.

Here, the Brazilian stock market performed strongly due to the flow of foreign investors attracted by the high level of domestic interest rates, the rise in commodity prices and the attractive appreciation of some assets on the stock market. As a result, the Brazilian index rose 6.06%, closing, once again, above the American stock exchange, which closed at 3.58%.

My portfolio, in March/2022, was a little behind the Brazilian index, closing at 5.72%, lower, however, than the Brazilian index of dividend-paying stocks (IDIV rose 10.00% in March 2022).

In the year, my portfolio has a return of only 6,12%. But that's just out of curiosity, as I don't care much about profitability, because what interests me is passive income. I also emphasize that the profitability presented here is not incorporated with the dividends received, because, adding the dividends, I would have a historical profitability of 39.34%.

Before continuing to show the performance of my portfolio, I decided to change what I had been doing and started to include foreign assets as well, as I intend to have part of my portfolio exposed to foreign investments.

POSITIVE AND NEGATIVE HIGHLIGHTS OF THE PORTFOLIO

GRND3 was the positive highlight in my portfolio. While on the negative side, the highlight was FLRY3

BUY SELL

Although in the last post I said that I would buy assets where prices give me a return of 6% a year in dividends and since prices are away from the highest point of the last 52 weeks, I have not fully followed this strategy of mine. This month I chose to also buy assets where prices are the lowest in the last 52 weeks and which have the potential to generate passive income.

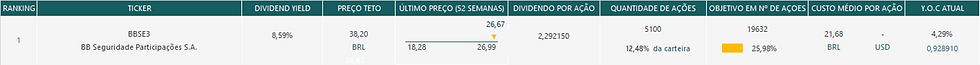

So, in March/2022, I bought two companies respecting the ceiling price of 6% in yield. I acquired another 100 shares of BBSE3 at R$22.01, thus totaling a contribution of R$2,201.00. With this acquisition, I now hold 5100 shares at an average price of R$21.68.

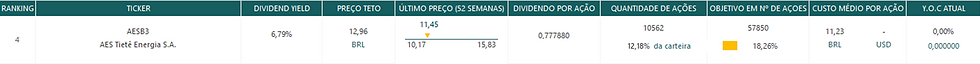

And another company that I bought respecting the 6% price ceiling was AESB3, I bought another 600 shares at R$10.83, thus totaling an investment of R$6,500.00, thus getting 10,362 shares at an average price of R$ 11.23.

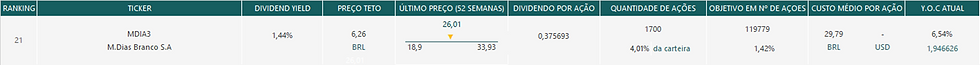

Also, I bought another 400 MDIA3 shares at R$20.47 and 400 FLRY3 shares at R$16.08 each. Although these companies are not within the 6% price ceiling, I bought them because, in addition to being at the lows of the last 52 weeks, they have great income generation potential, and FLRY3 would still pay dividends the value of R $0.71 per share to all shareholders with shares on 03.22.2022, which represents 4.44% yoc on the purchase price. Dividends will be paid on 04.04.2022.

It is also observed that, in this year alone, adding to what will be paid, MDIA3 has already given me 6.54% in dividends, which shows the success in purchases.

I also purchased two foreign assets: PK (5 shares at USD 17.01) and ARVL (USD 3.01), thus totaling BRL 446.98 and BRL 158.19 in reais. For now, I will not write about foreign assets, as I have not yet decided on which strategy I will use abroad.

So, at the end of the month, I contributed R$ 23,930.17. Finally, I emphasize that I did not buy ENBR3, behold, despite having written that I would buy it, the share appreciated too much, which made me buy other assets.

NEXT ACQUISITIONS

If in the next month, the stock prices are below or remain the same as the closing of Março/2022, I will possibly buy with the following companies:

I emphasize that foreign assets are included within my dividend strategy with a ceiling price of 6%; however, I have not yet decided whether I will continue with this strategy for such assets.

In any case, I believe that, in the next month, I will possibly buy those companies that pay a dividend greater than 6% and that the current prices are far from the highest price of the last 52 weeks; or, even if the company is not within the 6% price ceiling, the stock is at the recent lows of the last 52 weeks and has the potential to generate dividends further down the road.

PASSIVE INCOME

This was the best month of March in terms of receiving dividends. I received BRL 2,662.89, that is, 3x more than I received in the same period in 2021.

This month, ITSA4 paid R$2,536.00 in dividends corresponding to a yield on cost of 2.49% after tax. Another Brazilian company that paid me dividends was MDIA3. I received R$72.25 in dividends, which represents a yield on cost of 0.14%. The remainder received in dividends came from foreign assets, which I will not say, as I do not know if I will adopt the dividend strategy on the American stock exchange..

NEXT DIVIDENDS

With the end of March, I already received the amount of R$ 11,488.80 in passive income in 2022, which is, therefore, the best quarter I have ever received dividends; in fact, almost double the dividends of the second best quarter (R$ 6,015.54, in 2019).

However, ten companies in my portfolio have already confirmed that they will pay me dividends this year, they are: ENBR3, ITSA4, MDIA3, ABCB4, TAEE11, FLRY3, BHR, APLE, PK and HST, which totals the amount receivable still dividends R$ 13,763.17.

EQUITY

I ended the month with an equity invested in shares of R$ 1,044,144.53, an amount higher than last month, as I decided to add my foreign assets. In fixed income, I ended the month with a balance of R$ 98,473.29.

So, at the end of the month, I ended up with an equity of R$ 1,142,617.82.

ALLOCATIONS

My portfolio continues with 25 risky assets, due to the inclusion of foreign assets. I still don't think about getting rid of any company in the next few months. After shopping, my wallet looked like this:

MY GOALS

My goal for this year is: i) to reach R$ 1,000,000.00 invested in shares; and, ii) receive R$ 45,000.00 in passive income.

Well then! At the end of the month, I ended up with a capital invested in shares of R$ 844,895.10.

And I also ended up with a passive income accumulated in the year of R$ 25,251.96 (graph below), including dividends that I will still receive, thus representing a return on cost of 2.93% (graph above).

I believe I will be able to achieve my goals this year. For that, I need to earn more money from my work (active income).

Bình luận