MONTHLY JOURNEY TO FINANCIAL FREEDOM: 53th

- BecomingFI

- Jul 4, 2022

- 9 min read

The main Brazilian stock index ended June with the biggest monthly drop since March 2020, which was marked by the initial impact of the coronavirus pandemic on the global financial market.

That month, the indicator fell by 29.9%, while now it has fallen by 11.5%. As a result, the Brazilian stock market started to accumulate a fall of 5.99% in the year. On the other hand, my portfolio had a less pronounced drop of 4.66%, surpassing the performance of the Brazilian dividend index, which ended the month with a drop of 8.38%.

The sharp drop in the last month of the first semester is explained by the bad mood of the markets abroad, amid fears of global recession and with financial agents following the progress of the proposed constitutional amendment in the Brazilian parliament that increases public spending on the eve of the elections.

As a result, my portfolio ended the first half of 2022 with an accumulated index of -2.50%, surpassing the Brazilian index, but falling behind the Brazilian dividend index, which recorded an appreciation of 4.58% in the year. Ufa! Nothing like having a defensive wallet. But that's just out of curiosity, as I don't care much about profitability, because what interests me is passive income.

But even though I don't care much about profitability, my financial control spreadsheet lacked a chart that showed me the profitability of my portfolio with dividends received, which I ended up doing:

It can be seen that on the dotted line is dividend yield and on the other dark solid line is no dividend. Over the years, the dotted line is expected to move away from the dark line, due to the effects of compound interest on dividend reinvestment.

Still in relation to my financial spreadsheet, I continued to make some updates: deleting unnecessary formulas and changing some graphics, such as, for example, my goals.

Finally, the month of June 2022 provided me with an excellent opportunity to invest and trade some foreign assets to stay focused on my passive income strategy.

POSITIVE AND NEGATIVE HIGHLIGHTS OF THE PORTFOLIO

FLRY3 was once again the positive highlight of my portfolio. While on the negative side, the highlight was GRND3.

Although foreign assets also suffered from the bad mood of the stock market this month, they did not drop much in my portfolio, due to the devaluation of the real against the dollar. The dollar ended June with a rise of 10.03%, which explains, for example, why the VOO ETF closed the month with a fall of 8.64%, but in my portfolio it appreciated 0.95%.

BUY SELL

With the strong drop, the month of June was the period to fill the cart. With the exception of AESB3, I bought all the shares of all the Brazilian companies that I had informed that I would buy in the last post.

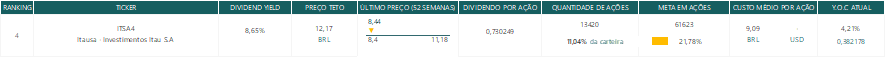

I had written that I would buy 500 ITSA4 shares at R$ 8.81. But I took advantage of the monthly discounts and bought 1500 ITSA4 shares worth R$ 8.75 each. As a result, I now have 13,420 shares at an average price of R$ 9.09.

I had also written that I would buy 200 FLRY shares at R$14.37, but I bought 400 shares at R$ 14.19 each. With that, I now have 5,500 shares at an average price of R$16.69.

I had also written that I would buy 200 shares of ABCB4 at R$15.66. I bought 600 ABC4 shares worth R$15.28 each. As a result, I now have 4207 shares at an average price of R$14.58.

However, on the sell side, I did not sell any GRND3 shares, as it did not reach the target selling price, but I won the premiums with the GRNDH110 option.

And in the American market I also went shopping, but I also took the opportunity to sell assets that were more valued so that I would not only have money to buy others, but also to stay more aligned with my dividend strategy.

I had written that I would buy only two assets: 01 DIS share at USD 99.72 and 04 PK shares at USD 17.01. But the sharp fall provided me with other opportunities. In fact, in addition to 01 DIS share at USD 99.72, I also bought: 103 PK shares at USD 14.44 each; 141 ARVL shares at USD 1.48; and, 4 MMM shares at USD 130.78.

But to buy these shares, I had to sell some assets. I sold the 02 shares of URA for USD 22.61, exactly the same amount and price that I said I would sell. I had written that I would sell 01 URNM share for US$ 72.21, but I sold 02 shares for US$ 67.71. I had written that I would sell 2 shares of HST for $21.59, but I sold my entire position of 13 shares for US$16.87. Likewise, I sold my entire position in NOBL and APLE, sold 4 NOBL shares at US$82.68, despite saying that I would sell 01 share at US$95.23 and 24 APLE shares at US$14,79, despite saying he wouldn't sell any. I sold 110 BHR at US$5.16, although I didn't say I would sell any.

I did not sell any shares of XHR, VOO, VNQ and NFLX, despite saying that I would sell 06 shares at USD 20.99, 01 share at USD 402.44, 01 share at USD 109.01 and 01 ad share at USD 220.93.

But, I decided to sell the most valued and/or low-yielding ones, and bought the assets that were more discounted (far from the historical maximum price of the last 52 weeks) and that would give me passive income (close to 6%).

That's why I chose to sell BHR, HST, NOBL and APLE assets and buy more PK and MMM. At the closing price of June/2022, PK has a maximum price of US$ 23.10, while it is trading at US$ 13.07, which will give me a yield of 10.60% if I continue to receive the average of last five years of dividends, which, for now, is not being done, so it enters my strategy of assets with the potential to generate passive income.

Already, MMM closed the month of June with a price of USD 127.49, while the ceiling price is USD 92.33, which will give me a yield of 4.35%, if it continues to receive the average of the last five years of dividends, the which is below what I intend (even below what APLE would pay me if I continued with it, read below), but as the company is resilient and its dividends have always been growing over the years, I will seek to invest in it as the price fell, even though it did not reach the 6% yield.

In fact, with the exception of ARVL, I would just stick with MMM with assets abroad, as it continues to pay dividends in times of crisis, unlike PK, which stopped paying dividends after the pandemic. So later on, if the PK goes up in value and the MMM goes down, I will possibly switch assets.

And to give you an idea, if I continued with HST, NOBL and APLE, I would continue to have an average yield in the last five years of 3.76%, 1.75% and 5.31%.

As for BHR, although I have a yield of 9.49%, I will continue to sell it so that I can buy more PK, as it gives me 10.60%:

I confess that I bought DIS in the excitement, I should have waited for it to drop more to buy more discounted and closer to the ceiling price.

So, in June/2022, I made BRL 39,131.12 in contributions and BRL 8,427.69 in sales.

NEXT ACQUISITIONS/SELLS

If next month stock prices are below or stay the same as June2022 close, I will possibly buy with the following companies:

In any case, I believe that, in the next month, I will possibly buy those companies that pay a dividend greater than 6% and that the current prices are far from the highest price of the last 52 weeks; or, even if the company is not within the 6% price ceiling, the stock is at the recent lows of the last 52 weeks and has the potential to generate dividends further down the road.

However, I will seek to continue with foreign assets that are more aligned with my investment strategy and that are still the best opportunities. So I think:

If the market continues to fall and because they are valued in my portfolio, I will sell more of my uranium ETFs (URA e URNM), because I bought in order to speculate.

If the market continues to fall, I will sell VOO to take advantage of other opportunities.

I will sell the VNQ, in case another asset is more devalued than it, but that has a greater potential to generate income than it. VNQ is not giving me much yield at current prices (3.56% at USD 92.75).

Exchange BHR for PK, since, based on the average of the last five years of dividends, the yield of the latter is higher than the former (10.60%, against 9.81%).

I will continue to buy MMM as its price drops to be more in line with my passive income strategy, and if PK rises in value and MMM continues at current levels, I will sell PK and take it.

I will avoid DIS, since despite being a good company, it does not have an attractive return on automatic prices.

Sell NFLIX as soon as the price rises or when there is an opportunity in another asset.

I will continue to buy ARVL until the amount invested in it represents 1% of my portfolio

Regarding my Brazilian assets:

keep liquidating GRND3 shares little by little while the price keeps going up, but in the meantime, I will be following the next results. I must do this by selling by selling.

I will continue to buy AESB3 if the price drops to less than R$ 10.21 or if it is the only contribution to make in the month. I stopped buying it after 10 months.

I will continue to buy ITSA4 if the price remains at the closing levels or below R$8.66

I will continue to buy ABCB4 if the price drops below R$15.00

I will buy SAPR11 again if the price drops below R$18.00

I will continue to buy FLRY3 if the price drops below BRL 14.00

I will buy ENBR3 if the price drops below R$19.00

Based on the comments above, I've scheduled the following orders until they're cancelled:

- Sell order: 02 shares of URA at USD 22.61;

- Sell order: 01 URNM share at USD 72.21;

- Sell order: 01 VOO share at USD 402.44;

- Sell order: 01 VNQ share at USD 109.01;

- Sell order: 06 XHR shares at USD 20.99;

- Sell order: 01 NFLX share at USD 220.23;

- Purchase order: 18 ARVL share at USD 1.27;

- Purchase order: 04 PK shares at USD 12.97 (order not shipped due to lack of money);

- Purchase order: 200 shares of FLRY3 at R$ 14.04;

- Purchase order: 200 shares of AESB3 at R$ 10.21;

- Purchase order: 300 ITSA4 shares at R$8.19;

- Purchase order: 100 ABCB4 shares at R$ 14.58;

- Purchase order: 100 SAPR11 shares at R$ 17.73;

- Purchase order: 200 ENBR3 shares at R$ 18,99;

- Sell order: 1900 shares from GRND3 (selling puts GRNDG105 at R$ 0.19;

PASSIVE INCOME

This was the best of June in terms of delivery receipts. I received BRL 3,868.38.

Almost all of this month's dividends came from SAPR11, whose company paid me R$3,767.63 in dividends corresponding to a yield on cost of 3.74% after tax. The rest came from MDIA3, APLE and VNQ, as shown in the image below:

NEXT DIVIDENDS

With the end of June, I already received the amount of R$ 30,100.01 in passive income in the year 2022, which corresponds practically to the total amount I received last year.

However, I still have to receive R$651.39 in dividends from the following companies: MDIA3 and ITSA4.

EQUITY

I ended the month with a net worth of shares of R$ 1,013,693.22, a value lower than last month. In fixed income, I ended the month with a balance of R$ 91,611.67.

So, at the end of the month, I ended up with an equity of R$ 1,105,304.89

ALLOCATIONS

My portfolio no longer has 28risky assets. My portfolio now has 25 assets, due to the sale of NOBL, HST and APLE. I continue to focus on keeping only those assets that generate passive income or have great potential to generate passive income.

I emphasize, however, that the only one that escapes this reasoning is the ARVL. I really like the concept they are bringing to the market, so I think about having 1% of it in my portfolio, which corresponds to R$ 10,000.00 or USD 2,000.00.

MY GOALS

My goal for this year is: i) to reach R$ 1,000,000.00 invested in shares; and, ii) receive R$ 45,000.00 in passive income.

Well then! At the end of the month, I ended up with a capital invested in shares of R$ 924,752.46

And I also ended up with a passive income accumulated in the year of R$ 30,751.33 (graph below), including dividends that I will still receive, thus representing a return on cost of 3.33% (graph above).

It can be seen, therefore, that I am getting close to my goal of one million reais invested in variable income, behold, with the amount I have in fixed income (R$ 91,611.67), I would already reach the goal. But of course my goal is to have a million invested, so I need the stock market to continue helping me, that is, for the stock to fall in price so I can invest what I have in my fixed income.

However, despite the fixed income amount reaching one million, I cannot use it all, as I need to keep around R$36,000.00 as a reserve fund, which would leave me with R$55,000.00 to reinvest; however, a good part of this amount I will not be able to get rid of, as it is serving as a guarantee for sales of options I made.

That is, I will still need to have an active income to be able to invest and get closer to the goal. As we are still in the middle of the year, I believe that by the end of the year I will have a value more than enough to reach one million, that is, something around R$ 76,000.00. But, I need to take advantage of the opportunities that the market is giving, so I will strive to seek that value as quickly as possible with my work.

And as for passive income, despite still being far from my goal of R$ 45,000.00, I see that my strategy is already having an effect, because, with the amounts that I will still receive in 2022, I am already reaching the same value I received last year from passive income (almost R$ 31 thousand ):

Keep going!!!!

Comments